All Categories

Featured

Table of Contents

That commonly makes them an extra affordable choice for life insurance policy protection. Numerous people get life insurance coverage to help economically protect their loved ones in instance of their unanticipated death.

Or you might have the choice to convert your existing term coverage into a permanent plan that lasts the rest of your life. Numerous life insurance policies have prospective benefits and drawbacks, so it's essential to recognize each before you decide to acquire a plan.

As long as you pay the premium, your beneficiaries will certainly obtain the survivor benefit if you pass away while covered. That stated, it is essential to note that most plans are contestable for two years which implies protection might be retracted on death, needs to a misstatement be discovered in the app. Plans that are not contestable frequently have a rated fatality advantage.

What is Term Life Insurance With Accelerated Death Benefit? A Simple Breakdown

Costs are generally lower than whole life policies. You're not locked into an agreement for the rest of your life.

And you can not squander your plan throughout its term, so you will not get any type of monetary gain from your previous insurance coverage. Just like various other sorts of life insurance policy, the cost of a level term plan relies on your age, coverage needs, work, way of living and health. Usually, you'll find much more economical insurance coverage if you're younger, healthier and much less high-risk to guarantee.

Considering that degree term premiums stay the very same for the duration of protection, you'll know specifically how much you'll pay each time. Degree term insurance coverage also has some adaptability, permitting you to personalize your policy with added features.

What is Joint Term Life Insurance? How It Helps You Plan?

You may have to satisfy particular conditions and qualifications for your insurance company to pass this rider. Furthermore, there might be a waiting duration of approximately six months before working. There also could be an age or time frame on the coverage. You can include a kid rider to your life insurance policy so it also covers your kids.

The survivor benefit is normally smaller sized, and insurance coverage usually lasts up until your youngster turns 18 or 25. This cyclist may be a more affordable way to assist guarantee your kids are covered as motorcyclists can typically cover multiple dependents at the same time. As soon as your youngster ages out of this insurance coverage, it may be feasible to convert the rider right into a new plan.

The most usual kind of permanent life insurance policy is entire life insurance, yet it has some essential distinctions contrasted to level term coverage. Below's a standard introduction of what to think about when contrasting term vs.

What is What Is Level Term Life Insurance? Your Guide to the Basics?

Whole life entire lasts for life, while term coverage lasts for a specific periodParticular The premiums for term life insurance policy are normally lower than entire life coverage.

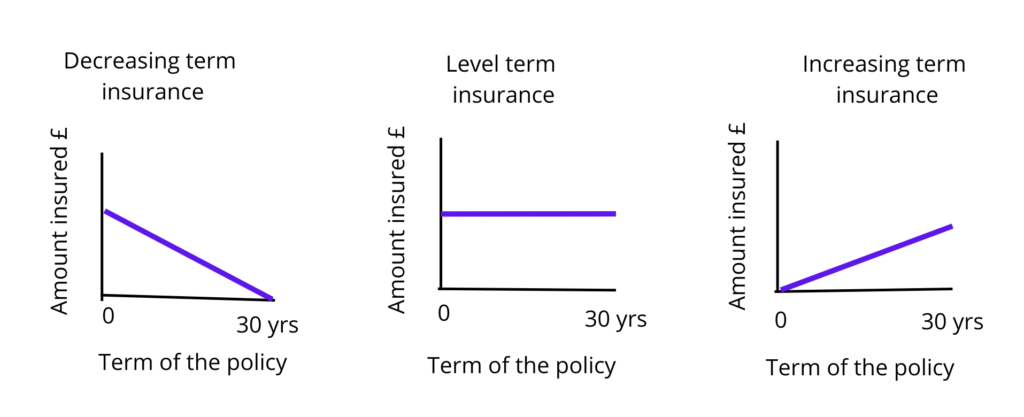

Among the main functions of degree term coverage is that your costs and your survivor benefit don't change. With reducing term life insurance coverage, your premiums remain the very same; nonetheless, the survivor benefit quantity obtains smaller gradually. For instance, you may have coverage that starts with a death benefit of $10,000, which could cover a home loan, and afterwards each year, the death benefit will decrease by a collection amount or percentage.

Due to this, it's frequently a much more inexpensive kind of degree term protection., however it might not be sufficient life insurance coverage for your requirements.

What is Level Term Vs Decreasing Term Life Insurance? Explained in Detail

After picking a policy, complete the application. For the underwriting procedure, you may need to give basic personal, wellness, way of life and employment information. Your insurer will certainly determine if you are insurable and the danger you might provide to them, which is mirrored in your premium costs. If you're authorized, authorize the documents and pay your initial premium.

You might desire to update your recipient information if you've had any type of substantial life adjustments, such as a marital relationship, birth or divorce. Life insurance policy can occasionally really feel difficult.

No, degree term life insurance policy does not have money worth. Some life insurance policy policies have a financial investment feature that allows you to construct cash worth gradually. A portion of your costs settlements is reserved and can make rate of interest gradually, which expands tax-deferred during the life of your protection.

You have some options if you still desire some life insurance protection. You can: If you're 65 and your coverage has run out, for example, you might desire to buy a new 10-year level term life insurance plan.

What Does Term Life Insurance For Seniors Mean for You?

You may have the ability to convert your term insurance coverage right into an entire life plan that will last for the remainder of your life. Lots of types of level term policies are convertible. That indicates, at the end of your insurance coverage, you can transform some or all of your plan to entire life insurance coverage.

A level premium term life insurance plan allows you stick to your spending plan while you assist secure your household. ___ Aon Insurance Solutions is the brand name for the broker agent and program administration operations of Fondness Insurance Providers, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Affinity Insurance Agency, Inc. (CA 0795465); in Alright, AIS Fondness Insurance Providers Inc.; in CA, Aon Affinity Insurance Coverage Providers, Inc .

Latest Posts

Whole Life Final Expense

Benefits Of Funeral Insurance

Funeral Trust Insurance Companies