All Categories

Featured

Table of Contents

You can obtain versus the money value of your plan for things like tuition settlements, emergency situations and also to supplement your retired life earnings (Accidental death). Bear in mind, this still is taken into consideration a loan, and if it's not repaid prior to you pass away, after that your death advantage is lowered by the quantity of the funding plus any kind of exceptional rate of interest

Essentially, a rider is used to personalize your policy to fit your needs. If you're terminally ill, an accelerated fatality advantage cyclist might pay out a portion of your fatality benefit while you're still alive. You might make use of the payout for points like medical expenses, to name a few usages, and when you die, your recipients will certainly receive a reduced life insurance policy benefit given that you made use of a portion of the plan currently.

Speak with your American Family members Insurance policy agent to see if your American Family Life Insurance provider plan has living advantages. In the meantime, take a look at our life insurance policy coverages to see which alternative is best for you and your enjoyed ones. This information stands for just a short description of coverages, is not part of your policy, and is not an assurance or guarantee of insurance coverage.

Insurance plan terms and conditions might apply. Exclusions may relate to policies, recommendations, or motorcyclists. Coverage might vary by state and might undergo transform. Some products are not available in every state. Please read your policy and call your representative for support. Plan Kinds: ICC17-225 WL, Policy Form L-225 (ND) WL, Plan Form L-225 WL, Plan FormICC17-225 WL, Policy Kind L-226 (ND) WL, Plan Form L-226 WL, Policy Type ICC17-227 WL, Policy Kind L-227 (ND) WL, Policy Kind L-227 WL, ICC21 L141 MS 01 22, L141 ND 02 22, L141 SD 02 22.

Is there a budget-friendly Death Benefits option?

Death advantages are generally paid in a swelling sum repayment., health insurance coverage, and tuition. At least 3 in four American adults showed they have some kind of life insurance coverage; however, ladies (22%) are twice as most likely as guys (11%) to not have any life insurance.

This might leave less money to pay for expenditures. Each time when your enjoyed ones are currently taking care of your loss, life insurance coverage can help ease some of the monetary burdens they might experience from lost income after your passing and aid provide a monetary safeguard. Whether you have a 9-to-5 work, are independent, or possess a small company, your current earnings may cover a section or all of your household's day-to-day needs.

44% responded that it would take less than six months to experience monetary difficulty if the key wage income earner died. 2 If you were to die unexpectedly, your other member of the family would certainly still require to cover these ongoing family expenditures even without your earnings. The life insurance death advantage can assist change earnings and make sure financial security for your liked ones after you are no much longer there to offer them.

How can I secure Final Expense quickly?

Your family members could make use of some of the fatality benefit from your life insurance coverage plan to assist pay for these funeral expenditures. The policy's recipient could guide some of the death benefits to the funeral home for final expenditures, or they can pay out-of-pocket and make use of the fatality advantage as compensation for these expenditures.

The ordinary expense of a funeral with funeral is virtually $8,000, and for a funeral with cremation, it's roughly $7,000. The "Human Life Worth" (HLV) idea relates to life insurance policy and monetary planning. It stands for an individual's worth in regards to their financial contribution to their household or dependents. Simply put, if that person were to drop dead, the HLV would estimate the financial loss that their family would incur.

Is Family Protection worth it?

Eighth, life insurance policy can be made use of as an estate preparation tool, aiding to cover any kind of essential inheritance tax and final costs - Cash value plans. Ninth, life insurance policy plans can offer particular tax advantages, like a tax-free survivor benefit and tax-deferred money worth accumulation. Life insurance policy can be a vital component of securing the financial protection of your enjoyed ones

Speak to one of our financial experts concerning life insurance policy today. They can assist you analyze your needs and locate the appropriate plan for you. Rate of interest is billed on car loans, they might generate a revenue tax obligation liability, minimize the Account Value and the Survivor Benefit, and might trigger the policy to gap.

What are the top Level Term Life Insurance providers in my area?

The Federal Government developed the Federal Employees' Group Life Insurance Policy (FEGLI) Program on August 29, 1954. It is the largest group life insurance policy program on the planet, covering over 4 million Federal staff members and retired people, in addition to several of their member of the family. The majority of staff members are qualified for FEGLI insurance coverage.

It does not develop up any type of cash money value or paid-up worth. It includes Fundamental life insurance protection and 3 choices. In many cases, if you are a new Federal worker, you are instantly covered by Standard life insurance policy and your payroll workplace deducts costs from your income unless you waive the insurance coverage.

You should have Standard insurance in order to choose any of the alternatives. Unlike Fundamental, registration in Optional insurance coverage is manual-- you need to take activity to choose the options (Life insurance). The cost of Standard insurance policy is shared in between you and the Federal government. You pay 2/3 of the complete price and the Federal government pays 1/3.

Where can I find Policyholders?

You pay the full cost of Optional insurance, and the expense depends on your age. The Workplace of Federal Employees' Team Life Insurance Policy (OFEGLI), which is a personal entity that has a contract with the Federal Federal government, procedures and pays cases under the FEGLI Program.

Possibilities are you might not have enough life insurance coverage on your own or your liked ones. Life occasions, such as getting wedded, having children and purchasing a home, may create you to require more protection. Term life insurance policy coverage is available to qualified workers. MetLife finances the life insurance policy protection.

You can enlist in Optional Life insurance and Reliant Life-Spouse insurance policy throughout: Your preliminary enrollment; Open registration in October; orA unique eligibility situation. You can sign up in Dependent Life-Child insurance coverage during: Your initial registration; orAnytime throughout the year.

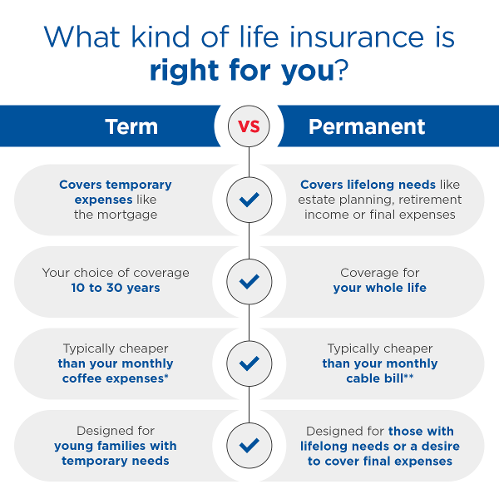

Consider your age, your monetary circumstance, and if you have individuals that rely on your earnings. If you decide to look for life insurance policy, there are some things to consider. You might wish to think about life insurance if others depend upon your income. A life insurance policy plan, whether it's a term life or whole life plan, is your personal building.

Is there a budget-friendly Living Benefits option?

Right here are several disadvantages of life insurance coverage: One downside of life insurance coverage is that the older you are, the a lot more you'll spend for a policy. This is since you're a lot more most likely to die during the policy period than a more youthful insurance policy holder and will, in turn, cost the life insurance policy firm even more money.

Latest Posts

Whole Life Final Expense

Benefits Of Funeral Insurance

Funeral Trust Insurance Companies